Spring Budget 2024: The Impact on Electric Car Salary Sacrifice

Key insights:

The Spring Budget 2024 confirmed that the Benefit-in-Kind (BiK) tax rate for electric company cars will remain at just 2% until 2025, then rise gradually by 1% per year - securing continued savings on salary sacrifice EVs through to at least 2028.

From April 2024, employee National Insurance Contributions (NICs) will be cut from 10% to 8% - slightly reducing salary sacrifice savings but increasing overall take-home pay for most employees.

Road tax will apply to all electric cars from 2025, including those obtained via salary sacrifice, but most new leases through The Electric Car Scheme will factor this into monthly pricing automatically.

April 2025: The Spring Statement has now been published and we have an update! Get up to speed on the latest information, and how the new tax changes may affect your EV salary sacrifice.

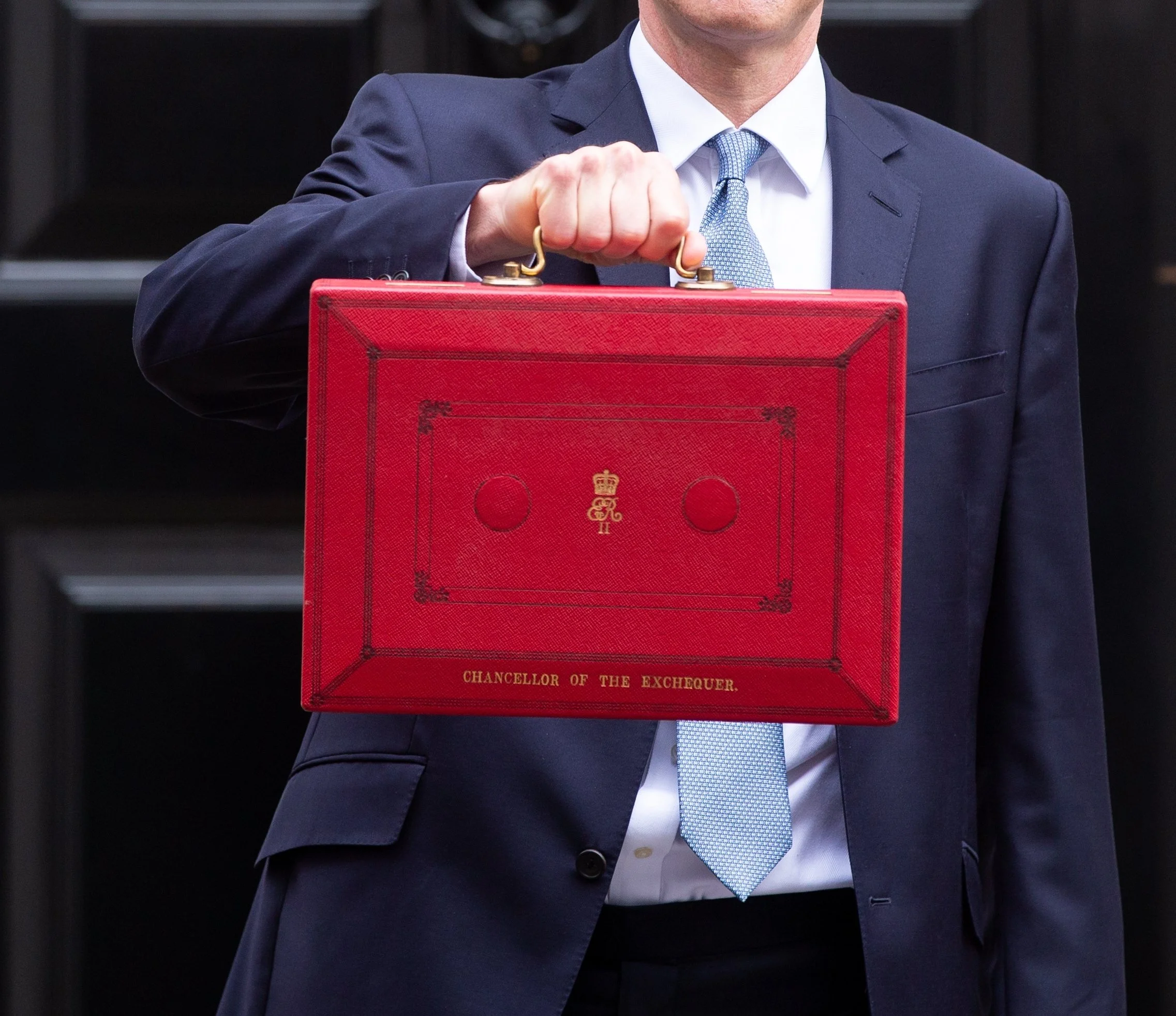

On Wednesday 6th March, the Chancellor of the Exchequer, Jeremy Hunt, announced the 2024 Spring Budget. This budget is anticipated to be the last significant announcement before the upcoming general election, which is likely to take place later this year.

The majority of the proposals were designed to support those hardest hit by the cost of living crisis as well as freezing alcohol and fuel duties that impact several consumers.

We have summarised these changes below and outlined how they may affect The Electric Car Scheme and electric car salary sacrifice schemes more broadly.

How does the 2024 Spring Budget impact electric car salary sacrifice?

The 2024 Spring Budget has been referred to as the ‘Budget for Long-Term Growth.’ According to the Government, it sticks to the plan of delivering lower taxes, better public services and more investment, all whilst aiming to increase the size of the economy by 0.2%. The main aim is to make the long-term decisions needed to build a brighter future.

Here is how the budget announcement impacts electric car salary sacrifice:

National Insurance Contributions

The Chancellor has said the core employee National Insurance Contribution (NIC) will be cut by 2 percentage points from 10% to 8% from the 6th April 2024. It’s currently charged at 10% on earnings between £12,571 and £50,271. The rate will remain at 2% of earnings on anything above that.

With the upcoming changes to National Insurance Contributions, your employees will experience a reduction in NICs for earnings between £12,571 and £50,271. While those who are in this earnings bracket and have a salary sacrifice electric car may see a slight decrease in their savings, they will still be better off as they'll be paying less in National Insurance Contributions overall. This therefore will translate to an overall increase in their take-home pay, which should be welcome news.

It is important to note that there is no change for those earning more than £50,271.

You can get an accurate quote for your chosen electric car, lease and level of incoming using our handy tax savings calculator on our website here.

No ‘new news’ on the Benefit in Kind tax incentive for electric cars

Benefit-in-Kind (BiK) rate is a tax that is charged for a company benefit - in the case of The Electric Car Scheme - the benefit is an electric car with significant tax savings through salary sacrifice. The benefit-in-kind (BiK) tax is currently set very low at 2% to encourage the adoption of electric cars.

In the Autumn statement 2022, Jeremy Hunt announced that the BIK tax will remain at 2% until 2025 and then rise by 1% every year thereafter until 2028. This means the tax savings available through getting a car with The Electric Car Scheme will continue until at least then.

Electric car drivers to pay road tax from 2025

As confirmed in the Autumn Statement 2022, electric cars are still not subject to road tax charges until 2025. However, from 2025 onwards, drivers of electric cars will start to pay road tax - and this includes any drivers that have a salary-sacrifice car.

This will typically be included in new leases, but those who already have an electric car will now have to pay to cover this new tax from 2025 onwards. You can read more about this on the Government Website.

How do these changes affect The Electric Car Scheme?

Overall, this is excellent news for any employer offering The Electric Car Scheme! It means our employee benefit will continue to provide you with the most affordable way to lease an electric car through to at least 2028 - and hopefully beyond. For more information about how the scheme works, visit our website.

Further notable announcements

The Chancellor covered many important areas which will affect everyday life. Here are some further notable announcements, which do not affect The Electric Car Scheme or electric car salary sacrifice explicitly, but they have a wider effect on the industry.

Fuel duty increases frozen.

Fuel duties are levied on purchases of petrol, diesel and a variety of other fuels. They represent a significant source of revenue for the government. The chancellor announced that the fuel duty increase will remain frozen for the 14th consecutive year and he will extend the 'temporary' 5p-a-litre cut for another 12 months. This is positive for those driving petrol and diesel cars.

Thom Groot, CEO of The Electric Car Scheme, has commented on this:

"The continuation of the freeze on fuel duty is nothing more than a fossil fuel subsidy worth billions of pounds a year, funds that could be far better spent on encouraging the uptake of electric cars. The flip-flopping and inconsistent policies over the last few years have led to confusion for the UK public, and dramatically slowed the uptake of electric cars.”

No further change in the National Minimum Wage.

The National Living Wage originally applied to people ages 25 and over. This reduced to 23 in 2021 and now, in 2024 this is reducing further to 21. There will be increases in hourly rates from 1st April 2024, which is great news!

Any of The Electric Car Scheme customers potentially affected by National Minimum Wage updates starting from April have been contacted and this is being resolved already.

VAT Registration Threshold will increase to minimum revenue of £90,000 per annum

This was previously £85,000. This small change only affects small businesses (who then do not need to charge VAT or should be able to recover VAT). The government says the investment will take about 28,000 businesses out of paying VAT, though many had hoped it would go as far as £100,000.

This should not affect our customers at The Electric Car Scheme, because we primarily work with companies with revenue exceeding this threshold.

Net Zero and Clean Energy Updates

The Spring Budget showed support and focus on nuclear energy and limited support for the transition to Net Zero. This includes £120 million in funding for the Green Industries Growth Accelerator, otherwise known as Giga, which is an investment programme for the expansion of low-carbon manufacturing supply chains in the UK.

Alongside this, the Chancellor also announced £270 million to advanced manufacturing industries to fund car and space innovation and to grow zero-emission vehicle and clean aviation technology.

The Windfall Tax on Oil and Gas companies has been extended by another year until the end of March 2029, unless energy prices and profits reduce substantially. Windfall Tax is a levy imposed by a government on companies that have benefited from something they were not responsible for - in other words, a windfall. Energy firm profits increased because of rising demand after Covid restrictions were lifted, and then because Russia's invasion of Ukraine raised energy prices. The windfall tax applies to profits made from extracting UK oil and gas.

Class 4 National Insurance has been reduced to 6%

For the self-employed, the government will introduce legislation to reduce the main rate of Class 4 National Insurance contributions by two percentage points from 8% to 6% from 6 April 2024.

This does not affect The Electric Car Scheme or our customers, but it does help the two million self-employed people in the UK.

If you are looking at making the switch to electric, why not consider salary sacrifice? You could save 20-50% on any electric car!

The Electric Car Scheme is an employee car benefit scheme that helps employees save on making the switch to an electric car. The way salary sacrifice works is that your employer will lease the car on your behalf and in return, you agree to pay through the gross pay (before tax) of your salary.

As a car through The Electric Car scheme is technically a ‘company car’ the employee is subject to a benefit-in-kind tax. This is currently set at 2% till 2025, and is factored into your quote.

Check out our EV salary sacrifice calculator to find your next car!

Images on this site are sourced from third party websites as listed below each image and are the property of their respective owners. If you believe any content infringes your copyright, please contact us at marketing@electriccarscheme.com.